41+ how much of salary should go to mortgage

Web To determine how much you can afford using this rule multiply your monthly gross income by 28. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

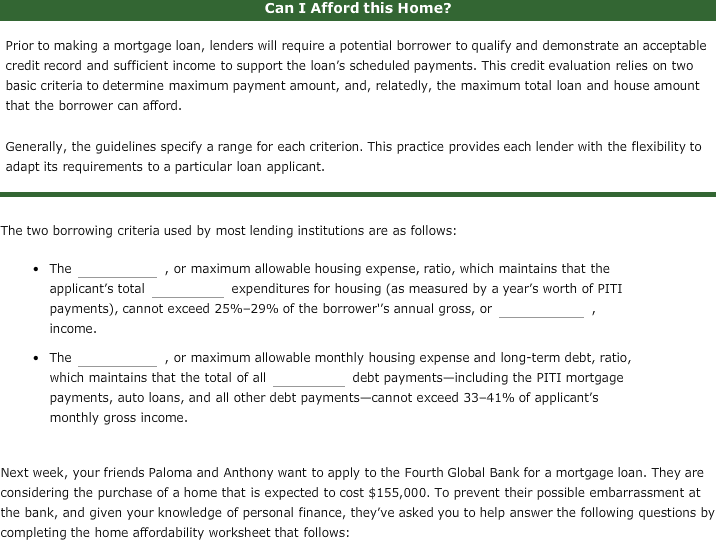

Solved First Filling The Blank A Back End B Front End Chegg Com

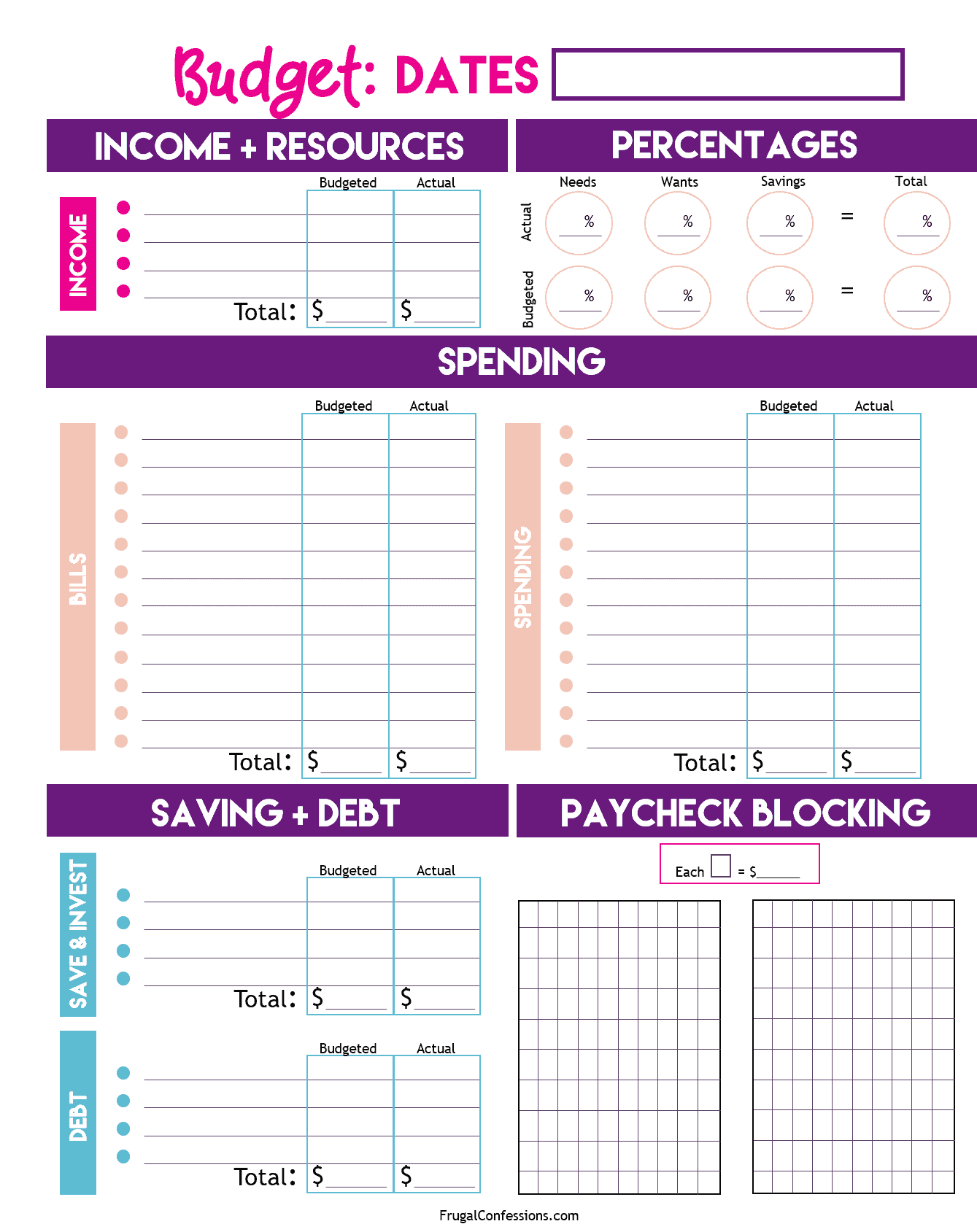

With a general budget you want to.

. Ideally that means your monthly mortgage. And you should make. Save Real Money Today.

So if your gross. Web The three times your salary rule and the less than 30 of your monthly income rule are both helpful guidelines. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Ad Highest Satisfaction for Mortgage Origination. Web Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Get Instantly Matched With Your Ideal Mortgage Lender. This rule says that you should not spend more than 28 of.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. But the amount you feel comfortable spending. Apply Online To Enjoy A Service.

Ad 10 Best House Loan Lenders Compared Reviewed. For example if you make 10000 every month multiply 10000 by 028 to get. Debt to income ratio 3485 divided by 10000 03485 3485 or 35 just under the suggested maximum.

Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Ad Compare Home Financing Options Online Get Quotes.

Get Your Home Loan Quote With Americas 1 Online Lender. Comparisons Trusted by 55000000. Ad 10 Best House Loan Lenders Compared Reviewed.

And they see a 28 DTI as an excellent one. Lock Your Rate Today. Web Keep your mortgage payment at 28 of your gross monthly income or lower.

Were not including any expenses in estimating the. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly.

Comparisons Trusted by 55000000. Keep your total monthly debts including your mortgage payment at 36 of your. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers.

Get Your Home Loan Quote With Americas 1 Online Lender. Thats a mortgage between 120000 and. Ad Compare Home Financing Options Online Get Quotes.

Web Total monthly household income before tax 10000. Lock Your Rate Today. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Get Instantly Matched With Your Ideal Mortgage Lender. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

How Much Mortgage Can I Get For My Salary Martin Co

Personal Loan Application Letter Templates At Allbusinesstemplates Com Application Letter Template Application Letters Loan Application

How Much Home Can You Afford Advanced Topics

12 Living Paycheck To Paycheck Stories From Real People

What Percentage Of Income Should Go To A Mortgage Bankrate

Mjd4luowjomtxm

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Affordability Calculator How Much House Can I Afford Zillow

Free 10 Monthly Budget Worksheet Samples In Pdf Ms Word Google Docs Google Sheets Excel

Which Global Stocks Are Overvalued Now And What Is Causing This Bubble Quora

How To Fill Out A Budget Sheet Simple Tutorial With Paycheck Blocking

Here S How Much You Need To Earn To Live In Denver Denver Co Patch

Hrm 14 03 Equal Access By Key Media Issuu

How Much House Can You Buy For 1 000 Per Month The Homa Files

What Percentage Of Your Income Should Go To Mortgage Chase

How Much House Can I Afford This Mortgage Affordability Calculator Tells You February 2023

Free 41 Sample Budget Forms In Pdf Ms Word Excel